China Renewable Energy Outlook shows pathways to a more sustainable energy future

China can reach its energy and environmental goals, but further policy measures are required for comprehensive energy transition to a sustainable low-carbon system. This is a main conclusion in the China Renewable Energy Outlook 2016, a new comprehensive study launched at the International Energy Transition Forum in Suzhou Monday 31 October 2016

“China needs energy for its further economic development but if we continue to rely heavily on coal, we will be stuck with an energy system, which pollutes, depletes our resources and confines us to the old industrial world”. Wang Zhongying, Vice Director General in ERI, director for China National Renewable Energy Centre and responsible for the China Renewable Energy Outlook, is serious about the problems created by the current energy system, but also optimistic about the future possibilities. “In tandem with the new industry revolution we must create a new energy revolution. Our analyses in the outlook show that renewable energy is ready to take the role as the back bone of the system within the next 15 years. A high share of renewables in the energy system in 2030 will not only reduce coal consumption and CO2 emissions substantially but also create a pathway towards a long-term low-carbon energy system”.

China Renewable Energy Outlook 2016 is the first renewable energy outlook from China Renewable Energy Centre (CNREC), a think tank within Energy Research Institute under NDRC. The Outlook analyses two scenarios for the future development of the Chinese energy system towards 2030.

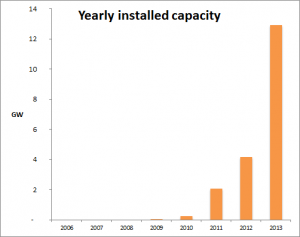

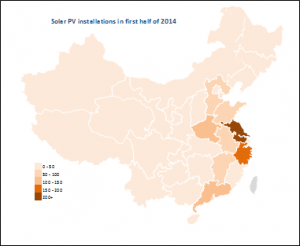

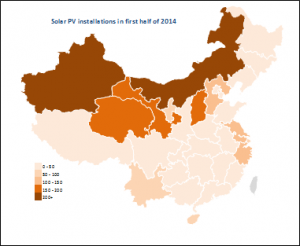

The “Stated Policy Scenario” shows the impact of the current energy policy in China and the “High Renewable Energy Penetration Scenario” analyses the possibility of going even further with the deployment of renewable energy. In the Stated Policy Scenario, wind power capacity soars from 130 GW today to 500 GW in 2030 and solar PV develops from 43 GW to 500 GW. As a result, coal consumption decreases and CO2 emissions stabilise ca 2025.

The High Renewable Energy Penetration Scenario has 1000 GW wind power and 1100 GW solar PV in 2030. Here CO2 emissions decrease from today’s level peaking before 2020 and in 2030 the emissions are reduced by 12% compared with today. Coal consumption is reduced by 28% compared with consumption today. The analyses show that it is possible to integrate large shares of renewable energy into the Chinese energy system if the right policy measures are implemented. An efficient power market, with transparent electricity prices, is the single most important driver for cost efficient integration of renewable energy. At the same time coal power will find a new role as providers of flexibility in a system where renewable energy takes over the role of back-bone of the power supply.

China Renewable Energy Outlook has been developed as part of the larger program for boosting renewable energy in China, supported by the Children’s Investment Fund Foundation and the Danish Government.

In Suzhou the Danish Deputy Permanent Secretary at the Danish Ministry of Energy, Utilities and Climate highlighted the importance of comprehensive studies like the China Renewable Energy Outlook. “The Outlook clearly shows the importance of flexibility in the power system. The Danish experiences show that coal fired power plants can be operated very flexibly and we are able to integrate very large amount of wind power, thanks to flexible power plants, efficient power markets and flexible use of the electric interconnectors”.

China Renewable Energy Outlook 2016 is the first issue from CNREC. After the launch in Suzhou the work on next year’s outlook begins together with the US based National Renewable Energy Laboratory, the Danish Energy Agency, and the new German partners GIZ, Agora Energiewende and DENA.

China Renewable Energy Outlook 2016 is available for download on CNREC’s website or you can download it here