Category Archives: Solar Energy

Trends in new capacity development in China

Four snapshots on RE in China 2018

China RE power 2005-2017 in five pictures

See how renewable energy has developed in China since 2005.

[infogram id=”china-re-power-development-2005-2017-1h0n25ddy0x96pe”]

Renewable energy enables an early peak of CO2 emissions in China

China Renewable Energy Outlook shows pathways to a more sustainable energy future

China can reach its energy and environmental goals, but further policy measures are required for comprehensive energy transition to a sustainable low-carbon system. This is a main conclusion in the China Renewable Energy Outlook 2016, a new comprehensive study launched at the International Energy Transition Forum in Suzhou Monday 31 October 2016

“China needs energy for its further economic development but if we continue to rely heavily on coal, we will be stuck with an energy system, which pollutes, depletes our resources and confines us to the old industrial world”. Wang Zhongying, Vice Director General in ERI, director for China National Renewable Energy Centre and responsible for the China Renewable Energy Outlook, is serious about the problems created by the current energy system, but also optimistic about the future possibilities. “In tandem with the new industry revolution we must create a new energy revolution. Our analyses in the outlook show that renewable energy is ready to take the role as the back bone of the system within the next 15 years. A high share of renewables in the energy system in 2030 will not only reduce coal consumption and CO2 emissions substantially but also create a pathway towards a long-term low-carbon energy system”.

China Renewable Energy Outlook 2016 is the first renewable energy outlook from China Renewable Energy Centre (CNREC), a think tank within Energy Research Institute under NDRC. The Outlook analyses two scenarios for the future development of the Chinese energy system towards 2030.

The “Stated Policy Scenario” shows the impact of the current energy policy in China and the “High Renewable Energy Penetration Scenario” analyses the possibility of going even further with the deployment of renewable energy. In the Stated Policy Scenario, wind power capacity soars from 130 GW today to 500 GW in 2030 and solar PV develops from 43 GW to 500 GW. As a result, coal consumption decreases and CO2 emissions stabilise ca 2025.

The High Renewable Energy Penetration Scenario has 1000 GW wind power and 1100 GW solar PV in 2030. Here CO2 emissions decrease from today’s level peaking before 2020 and in 2030 the emissions are reduced by 12% compared with today. Coal consumption is reduced by 28% compared with consumption today. The analyses show that it is possible to integrate large shares of renewable energy into the Chinese energy system if the right policy measures are implemented. An efficient power market, with transparent electricity prices, is the single most important driver for cost efficient integration of renewable energy. At the same time coal power will find a new role as providers of flexibility in a system where renewable energy takes over the role of back-bone of the power supply.

China Renewable Energy Outlook has been developed as part of the larger program for boosting renewable energy in China, supported by the Children’s Investment Fund Foundation and the Danish Government.

In Suzhou the Danish Deputy Permanent Secretary at the Danish Ministry of Energy, Utilities and Climate highlighted the importance of comprehensive studies like the China Renewable Energy Outlook. “The Outlook clearly shows the importance of flexibility in the power system. The Danish experiences show that coal fired power plants can be operated very flexibly and we are able to integrate very large amount of wind power, thanks to flexible power plants, efficient power markets and flexible use of the electric interconnectors”.

China Renewable Energy Outlook 2016 is the first issue from CNREC. After the launch in Suzhou the work on next year’s outlook begins together with the US based National Renewable Energy Laboratory, the Danish Energy Agency, and the new German partners GIZ, Agora Energiewende and DENA.

China Renewable Energy Outlook 2016 is available for download on CNREC’s website or you can download it here

Will China reach it’s 2014 targets on Solar PV?

3,3 GW new installed capacity in the first half year of 2014 is indeed impressive for the Chinese solar PV development, but it is quite far from the 14 GW the National Energy Administration (NEA) announced as target for 2014 in the beginning of the year.

The installed capacity in the first half of 2014 might not be alarmingly low. In 2013, where the total new installed capacity reached 13 GW, the main installations happened in the second half of the year. The newly released figures for 2014 might however have given NEA reason to reassess the 2014 targets. Several sources cite the head of NEA, Wu Xinxiong, for new 2014 targets: PV-Tech.org says the new target is 13 GW, mainly from distributed PV, while the July Briefing paper from AECEA cite Wu Xinxiong for a target as low as 10 GW. AECEAs own estimation is however more in line with the 13 GW that PV-Tech.org quote.

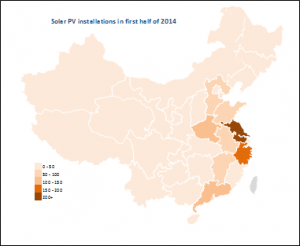

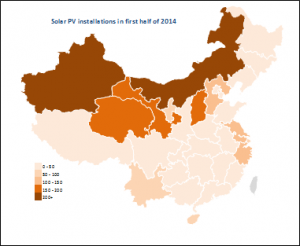

The main difference between 2013 and 2014 is that NEA now has high priority to distributed PV installations. In 2013 only 1 GW of the total 13 GW new installed capacity was distributed PV capacity, while 12 GW was utility based solar power plants. The targets for 2014 from the beginning of the year were 8 GW distributed PV capacity and 6 GW utility based capacity. The figures for first half of 2014 shows 1 GW distributed capacity and 2.3 GW utility based capacity.

The regional distribution of the new installed capacity for first half of 2014 is clear: The solar power plants are installed in the North and North West China, with Xinjiang in the top with 900 MW, while the distributed capacity is installed in East and South China.

Kick-off of the China Solar Roadmap

This week the preparation of a comprehensive Chinese solar roadmap was launched in Beijing. The roadmap will look at solar PV, concentrated solar power (CSP) and solar thermal technologies and analyse the technology development trends, international and national market trends as well as the possibilities and challenges for the Chinese solar manufactures. The roadmap will be finalised by the end of 2013.

The Solar Roadmap is sponsored by the Sino-Danish Renewable Energy Development (RED) Program and it is supervised by the China National Renewable Energy Centre – CNREC. The analyses will be carried out by a large number of leading Chinese experts under the umbrella of China Renewable Energy Society supported by international solar experts participating in the IEA Solar Technology Initiatives.

At the kick-off meeting on 29 January 2013 I had the possibility to wrap up the plenum discussion with these words:

“We already have a number of international and national solar roadmap and it is of course very useful to learn from these experiences. But it is also important to realise that the Chinese roadmap should focus on the Chinese context. The solar market is a global market with China as one of the major players on the manufacturing side. Thus the roadmap should look into the international market development expectations. Also the technology development is international and international development trends are therefore important frameworks for the Chinese roadmap. But the Chinese roadmap must address the challenges and possibilities for solar in the Chinese energy system, and also address the short term an long term possibilities and challenges for the solar manufactures.

The Chinese ambitions on deployment of solar installations are very ambitious, especially on the PV installations. This month NEA announced a target of 10 GW of installed capacity for 2013, about 10 times the installation in 2012. For solar thermal, especially large scale systems, the potential might not have be fully understod yet. For both technologies this roadmap will be very important to clarify both the short term and long term challenges and possibilities and also to look into the different policy measures suitable for ensuring the deployment.

The Chinese RE industry is wisely considered as one of the strategic emerging industries in China, and the Chinese solar PV Industry has certainly shown its ability to move quickly. But today the PV industry is in trouble. Production capacity is much higher than the current market demand, and it is difficult to quickly adjust this capacity downwards again. This partly explains the urgent need to stimulate the national market, but even the 10 GW goal might not solve the problem for the PV-industry. At the same time the technology breakthrough of new systems might be just around the corner, which again will challenge the Chinese manufactures. Will they be able to become front runners in this development or will they be stuck with the old technology solutions? I think this roadmap will be particular important for the solar industry as a basis for understanding both the national and international market and as a tool for understanding the emerging technologies which are necessary to implement in the future in order to survive and grow. I hope the team will use the working process to frequent consult with the industry, both to get inspiration and input but also to provide and discuss the result with this very important stakeholder group.

Should the roadmap be consistent with the current national energy plans? Not necessarily! Road maps should point to possibilities and expand the knowledge of these technologies. Roadmaps are in my opinion front runners for energy plans. Then of course the energy plans might have other considerations which will deviate from the roadmaps and that is actually no problem to have these different perspectives. So I encourage you to be bold regarding potentials and possibilities including ambitious long time goals but also to be realistic regarding the challenges and needs for implementing measures.

I am very happy to see that the working team include the best Chinese solar experts. This is very promising for the quality and success of the roadmap. I am of course also happy that it has been possible to include the Danish experts in the work contributing with experiences from Europe and from the important work in the IEA technology groups.

I wish you good luck with this important and exciting study. I am looking forward to follow the work and to see the first roadmap by the end of this year”.

China 2012: Slowing down on RE deployment

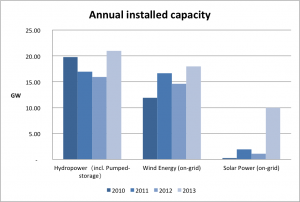

Fresh figures from China’s State Electricity Regulatory Commission (SERC) shows stagnation in the 2012 deployment of renewable energy in China. According to SERC, 15 GW of hydro power, 13 GW of wind power and 1 GW of solar power were established in 2012. These figures are less than the similar figures for 2011 for all three technologies.

The stagnation in the annual new installed capacity of wind power and solar power underline the serious and deep crisis for the Chinese RE industry. Both the wind industry and the solar industry are suffering from lack of orders and huge mismatch between production capacity and market demand.

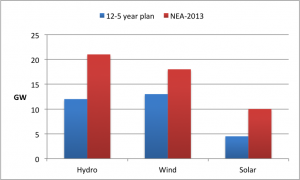

NEA’s recent announcement of ambitions for 2013 aims to break the trend and to reestablish old growth trends. As shown in the figure comparing the annual installed capacity in 2010, 2011 and 2012 with the NEA ambitions for 2013: More hydro, more wind, and 10 times more solar!

2013 to become a big year for RE in China

The National Energy Administration in China have high expectations for the development of renewable energy in China in 2013. The 12th 5 year plan for renewable energy, which was launched last year set the targets for 2015 for the various technologies at a fairly ambitious level; 260 GW hydro power, 100 GW grid connected wind power and 21 GW solar power should be installed by 2015. Compared to the 2011 level this gives average annual increases of 12 GW per year for hydro power, 13 GW per year for wind power and and 4.5 GW for solar power. But NEA now expect 21 GW hydro power, 18 GW wind power and 10 GW solar power to be installed in 2013 – all higher the the average yearly targets from the 12th 5 year plan.

So despite the current challenges for integration of renewables into the Chinese electricity grid, including lacking regulation and incentives for distributed solar power, NEA is quite optimistic or ambitious regarding the possibilities for deployment of RE in 2013.

Are the ambitions realistic? Well past experiences have shown that massive yearly deployment is possible, so it is difficult just to judge the 2013 targets as unrealistic. On the other hand the current challenges for integration and deployment cannot be easily delt with. Action is needed to avoid curtailment by making the electricity system much more flexible. And the deployment of solar power requires focus on large scale deployment of small scale solar power systems, roof-top and building integrated systems. And the barieres for such system might be underestimated when the 2013 targets were set. However, the signals from NEA is very encouraging: RE must have a bigger role in the Chinese energy supply in the future, and with these ambitions it is sure that a lot of effort will be made to quickly remore the barriers for deployment and integration of RE.

(Let me add that the figures might not be as easy to compare that shown. The figures for the 12th 5 year plan are grid-connected capacity, which for wind power make a big difference from the total installed capacity. It is not clear if the NEA 2013 figures also are grid-connected capacity or total installed capacity)

The minutes from the NEA working meeting where the targets were set, can be found on the NEA web site. The meeting ended up with eight focus areas for NEA in 2013, including increased domestic energy supply, more renewable energy, control of the total energy consumption, preparation of an energy sector reform, enhanced international energy cooperation, more research and demonstration, electricity to people without electricity supply, and strengthen of the management of the energy sector. It looks like a quite busy year for the energy administration, also in 2013 :-).

High expectations for solar PV development in China – but can they be met?

The solar PV development in China and in the world are one of the main themes in the brand new issue of China Renewable Energy Magazine from CNREC

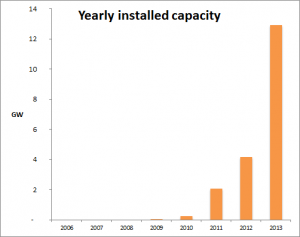

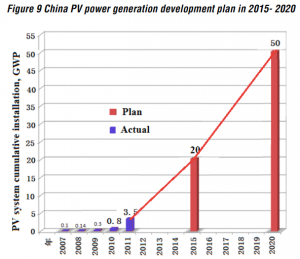

Experts from Energy Research Institute of NDRC, China Photovoltaic Society and State Grid Energy Research Institute give in the new issue of the CNREC RE Magazine a quite comprehensive and in-depth view of the recent and future development of the solar PV industry and market (the figures below are from the magazine).

The 12th 5-year plan set out clear and ambitious targets for the development of solar PV in China. 20 GW installed capacity is the target for 2015 and 50 GW is the target for 2050. In 2011 3.5 GW is installed. The plan focuses both on large PV power plants and on distributed PV systems, including roof-top and building integrated installations. But is it possible to have such a rapid development in China the next 5-10 years?

The 12th 5-year plan set out clear and ambitious targets for the development of solar PV in China. 20 GW installed capacity is the target for 2015 and 50 GW is the target for 2050. In 2011 3.5 GW is installed. The plan focuses both on large PV power plants and on distributed PV systems, including roof-top and building integrated installations. But is it possible to have such a rapid development in China the next 5-10 years?

From an incentive point of view, Wang Sicheng from NDRCs Energy Research Institute (ERI) points out that the RE law from 2005 and 2009 is a sufficient overarching framework for the development of solar PV in China. The law has been follow by detailed implementation of support schemes for demonstration project and a Feed-In Tariff (FIT) for large PV power plants. Nevertheless there are still a number of barriers for the large PV installations:

- Difficulties in connection to the transmission grid

- High Land use tax

- Unclear lenght of the FIT subsidy

- Severe delays in the payment of the subsidy

- Bad timing between planning of the PV power plants and the grid planning

The development of distributed PV installations has until now happened as part of the demonstration programs, e.g. the Golden Sun projects. And here the development has run into a series of barriers:

- Difficulties in connecting to the distribution net

- Difficulties in setting up contracts with the grid companies

- Unclear or missing standards for grid connection etc.

Zhao Yuwen from China Photovoltaic Society (CRES) look at the solar PV development from an industry point of view. In general he agrees with the ideas of promoting FIT for solar PV and to have better timing between grid and solar PV development. On top of this he points to some industry specific challenges. It is a big challenge for the Chinese solar PV industry that the Chinese market only is around 10 percent of the Chinese production. A more solid home market is needed to avoid severe damage from protectionism in international trade. Furthermore the Chinese solar PV industry have problems to become competitive with foreign manufactures when it comes to some of the components in solar PV panels, e.g. polycrystalline silicon and some high-end raw and auxiliary materials.

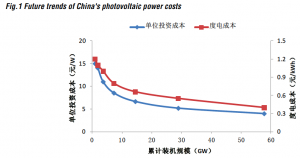

Finally Cao Shiya from the State Grid Energy Research Institute looks at the technical and economic development of different solar PV systems. One of the main points is that the rapid development of installations allows for further improvement of the levelized cost of electricity from solar PV. He expects the cost to be half of the current cost in 2020.

Finally Cao Shiya from the State Grid Energy Research Institute looks at the technical and economic development of different solar PV systems. One of the main points is that the rapid development of installations allows for further improvement of the levelized cost of electricity from solar PV. He expects the cost to be half of the current cost in 2020.

There is a wealth of information about the past, present and future development of solar PV systems in all three articles, not only for China but also for the global development. If you are interested in solar PV in China, CNRECs 3th RE Magazine is a must-read. On top of this you get a lot of other interesting article about policy, industry and data about renewable energy. Download the Magazine from CNREC web site in Chinese or English.